Table Content

About Broadcom Inc.

Investing in Broadcom Inc. (AVGO) from India

Broadcom Inc. (AVGO) has yielded substantial returns for Indian investors

Broadcom Inc. (AVGO) among Indian investors sentiment

Why are Indians interested in investing in Broadcom Stock (AVGO) from India?

Broadcom Inc. is led by a distinguished team of executives

FAQ

Conclusion

About Broadcom Inc.

Broadcom Inc., established in 1961 and headquartered in San Jose, California, is a leading global provider of semiconductor and infrastructure software solutions. As of December 2024, the company achieved a market capitalization exceeding $1 trillion. Broadcom’s extensive portfolio encompasses technologies that drive advancements in 5G, AI, IoT, and cloud computing, playing a pivotal role in enabling high-speed communication and digital transformation across various industries.

Organizational Structure:

Broadcom operates through two primary segments:

Semiconductor Solutions:

This division focuses on designing and manufacturing a wide range of semiconductor products, including data center networking chips, broadband access chips, and wireless communication chips.

Infrastructure Software:

This segment offers enterprise software solutions, including those for mainframe and server-based computing environments.

Leadership Team:

The company is led by a team of seasoned executives:

Hock E. Tan: President, Chief Executive Officer, and Director.

Kirsten Spears: Chief Financial Officer and Chief Accounting Officer.

Charlie Kawwas: President, Semiconductor Solutions Group.

Mark Brazeal: Chief Legal Officer.

Alan Davidson: Chief Information Officer.

Recent Developments:

Acquisition of VMware:

In November 2023, Broadcom completed the acquisition of VMware, a global leader in cloud infrastructure and digital workspace technology. This strategic move expanded Broadcom’s software offerings and strengthened its position in the enterprise software market

Financial Performance:

In the first quarter of 2025, Broadcom reported a revenue of $14.92 billion, marking a 25% year-over-year increase. Earnings per share rose from $0.28 to $1.14 during the same period.

(Read exclusive investment updates on TapluMarket.com)

Investing in Broadcom Inc. (AVGO) from India

Investing in Broadcom Inc. (AVGO) from India is facilitated by platforms that allow Indian residents to trade U.S. stocks. One such platform is INDmoney, which enables users to invest in U.S. stocks, including Broadcom

Quantity-Based Investment:

Decide on the number of shares you wish to purchase.

Value-Based Investment:

Specify the amount in INR or USD you intend to invest.

Systematic Investment Plan (SIP):

Set up a recurring investment to buy shares at regular intervals (e.g., weekly or monthly) with a fixed amount.

Execute the Trade:

Review your order details and confirm the transaction. The platform will handle the execution, converting your INR to USD if necessary, and purchasing the corresponding number of Broadcom shares.

For example, if you invest ₹100, the platform will calculate the equivalent USD amount based on the current exchange rate and purchase the fractional shares of Broadcom that correspond to that investment.

Broadcom Inc. (AVGO) has yielded substantial returns for Indian investors

Investing in Broadcom Inc. (AVGO) can offer attractive returns for Indian investors, especially when considering both the stock’s performance and currency fluctuations. Here’s an overview based on an investment of ₹1,00,000:

Current Investment Value:

As of today, an investment of ₹1,00,000 in Broadcom shares would be worth approximately ₹1,32,753, reflecting a total return of ₹32,753 (+32.75%).

Breakdown of Returns:

Stock Performance:

Returns from Broadcom’s stock appreciation account for ₹27,541 (+27.54%).

Currency Appreciation:

Fluctuations in the USD/INR exchange rate contribute an additional ₹5,213 (+5.21%).

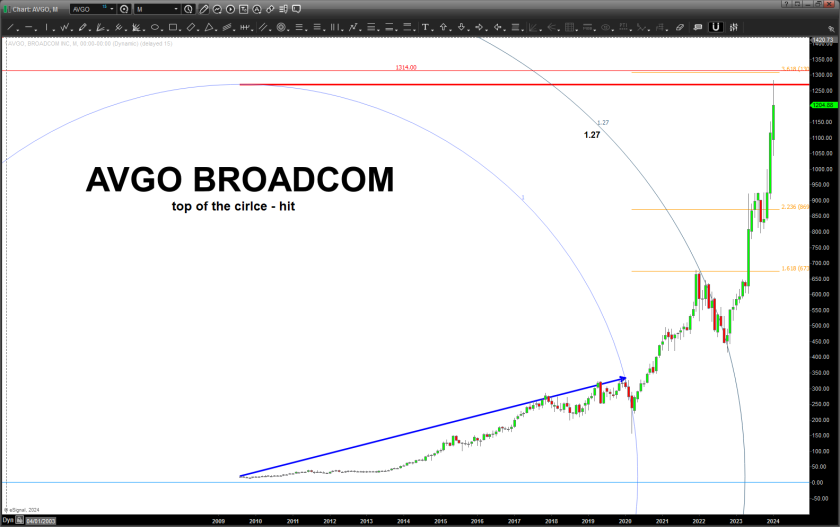

Historical Performance:

Over the past 10 years, Broadcom’s stock has delivered a total return of approximately 1,899.90%, equating to an average annual return of about 36.65%.

To estimate potential returns based on different investment amounts and durations, you can use online tools like the Broadcom Stock Calculator provided by Finlo.

These calculators allow you to input your investment value and time horizon to project future returns, considering both stock performance and currency fluctuations.

Considerations for Indian Investors:

Currency Risk:

Investments in U.S. stocks are subject to currency risk due to fluctuations between the Indian Rupee (INR) and U.S. Dollar (USD). Tools like the one mentioned above help account for these variations when calculating returns.

Regulatory and Tax Implications:

It’s essential to understand the regulatory framework and tax obligations associated with investing in foreign stocks. Consulting with financial advisors or experts can provide clarity on these aspects.

Broadcom Inc. (AVGO) among Indian investors sentiment

Investor sentiment towards Broadcom Inc. (AVGO) among Indian investors has experienced notable shifts, influenced by the company’s strategic advancements and market performance.

Positive Developments:

AI Chip Market Position:

Broadcom’s growing presence in the AI chip sector has caught investors’ attention. A Citi survey revealed that 76% of investors view Broadcom positively, approaching Nvidia’s 84%. This shift indicates increasing confidence in Broadcom’s AI capabilities.

Financial Performance:

In its recent quarterly report, Broadcom reported a 51% year-over-year revenue increase to $14.05 billion, with a net income rise of 23% to $4.32 billion. Such robust financials have bolstered investor confidence.

Concerns:

Valuation Scrutiny:

Despite positive trends, some analysts expressed caution due to Broadcom’s high price-to-earnings (P/E) ratio of 180x, suggesting potential overvaluation. This has led to a more cautious outlook among certain investors.

Market Competition:

The semiconductor industry remains competitive, with companies like Nvidia making significant strides in AI. While Broadcom is gaining ground, investors remain vigilant about its position relative to competitors.

Indian Investor Behavior:

Recent data indicates a decrease in Indian investor activity concerning Broadcom:

Transactional Activity:

There has been a 32.34% drop in investments in Broadcom shares over the past 30 days, suggesting reduced trading interest.

Search Interest:

Search interest for Broadcom stock among Indian investors has declined by 21% in the last 30 days, reflecting waning curiosity.

These trends may result from a combination of global market dynamics, company performance, and shifting investor priorities.

(Read exclusive investment updates on TapluMarket.com)

Why are Indians interested in investing in Broadcom Stock (AVGO) from India

Indian investors are increasingly interested in investing in Broadcom Inc. (AVGO) due to the company’s significant presence and strategic initiatives in India, coupled with its robust global performance.

Broadcom’s Strategic Investments in India:

Expansion of Operations:

Broadcom has significantly expanded its operations in India, particularly after acquiring VMware in 2022. The combined revenues of VMware, LSI India R&D, CA India Technologies, and Broadcom Communications exceeded ₹15,834 crore in FY24, marking a 44% increase over the previous year.

Research and Development (R&D) Focus:

The company operates substantial R&D centres in India, with a focus on developing solutions tailored for emerging markets, including the Internet of Things (IoT) and wearables. The Bangalore R&D unit, for instance, employs approximately 1,500 people dedicated to these initiatives.

Employment and Investment:

Broadcom plans to increase hiring in India, emphasizing the country’s role in product development and support. The company highlights its contributions to sectors such as government and financial services, acknowledging India’s growing public sector business as a key area of focus.

VMware’s Significant Contribution:

VMware, now part of Broadcom, has been operating in India for over 15 years, with more than 5,000 employees across Bangalore, Pune, and Chennai. In 2018, VMware announced a $2 billion investment in India over five years, underscoring the country’s importance in its global strategy.

Global Performance and Innovation:

Financial Growth:

In FY24, Broadcom reported a 44% year-on-year revenue surge to a record $51.6 billion, bolstered by a $21.5 billion increase in infrastructure software revenue following the successful integration of VMware.

Investment in Research and Development:

Broadcom invested $5.3 billion in R&D in FY23, amassing over 23,000 patents across 26 divisions. This commitment to innovation is evident in its role in powering technologies ranging from smartphones to industrial automation.

Leadership in AI:

Broadcom’s AI chip sales soared to $4.2 billion in FY23, with projections to reach $16.9 billion by FY25, driven by the increasing demand for custom AI processors and networking chips.

Broadcom Inc. (AVGO) has demonstrated significant financial growth in recent years, both globally and within the Indian market. Here’s an overview of its financial performance, presented in both U.S. Dollars (USD) and Indian Rupees (INR):

Global Financial Performance:

Fiscal Year Revenue (USD) Net Income (USD) Adjusted EBITDA (USD)

2021 $27.45 billion $6.44 billion N/A

2022 $33.20 billion $11.22 billion N/A

2023 $35.82 billion $14.08 billion $9.09 billion

2024 $51.57 billion $5.90 billion $31.90 billion

Exchange Rate:

As of March 7, 2025, the exchange rate is approximately 1 USD = 82 INR.

Financial Performance in INR:

Fiscal Year Revenue (INR) Net Income (INR) Adjusted EBITDA (INR)

2021 ₹2,254,000 crore ₹528,000 crore N/A

2022 ₹2,724,400 crore ₹920,000 crore N/A

2023 ₹2,940,440 crore ₹1,155,360 crore ₹746,380 crore

2024 ₹4,226,340 crore ₹483,800 crore ₹2,615,580 crore

Recent Developments:

In the fiscal fourth quarter of 2024, Broadcom reported a revenue of $14.05 billion, a 51% year-over-year increase. Net income was $4.32 billion, with an adjusted EBITDA of $9.09 billion, representing 65% of revenue.

The company’s AI-related revenue more than tripled, reaching $12.2 billion, driven by demand for custom AI processors and networking chips

Broadcom’s market capitalization surpassed $1 trillion for the first time, reflecting strong investor confidence, especially in its AI semiconductor market prospect

Broadcom Inc. is led by a distinguished team of executives

Broadcom Inc. is led by a distinguished team of executives, each bringing extensive experience to their respective roles. As of March 2025, the key members of Broadcom’s management team include:

Mr. Hock E. Tan: President, CEO, and Executive Director.

Ms. Kirsten M. Spears: Chief Financial Officer (CFO) and Chief Accounting Officer.

Mr. Mark D. Brazeal J.D.: Chief Legal and Corporate Affairs Officer.

Dr. Charlie B. Kawwas Ph.D.: President of Semiconductor Solutions.

Mr. Alan Davidson: Chief Information Officer.

Mr. Ji Yoo: Director of Investor Relations.

Ms. Jill Turner: Vice President of Human Resources.

Mr. Frank Ostojic: Senior Vice President and General Manager of the ASIC Products Division.

Mr. Rich Nelson: Senior Vice President and General Manager of the Broadband Video Group.

FAQ

Qes. What is the future price of Broadcom stock?

Analysts project Broadcom’s stock (AVGO) to reach an average of $225.04 within the next 12 months, with estimates ranging from $170.00 to $260.00.

Given its current trading price of approximately $189.84, this suggests a potential upside of about 18.5%.

Qes. Why did Broadcom’s share price drop?

Broadcom’s stock (AVGO) recently experienced a decline due to broader market concerns, including tariff uncertainties under President Trump’s administration, which led to significant sell-offs in technology stocks. Additionally, despite reporting strong AI revenue growth, some investors expressed caution over the sustainability of AI spending and broader market challenges, contributing to stock volatility.

Qes. What is the 5-year return of AVGO?

The 5-year total return for AVGO stock is 696.58%

Qes. Is Broadcom a buy in 2025?

Analysts are optimistic about Broadcom’s (AVGO) prospects in 2025. The company reported strong AI semiconductor demand, with a 77% revenue increase last quarter

Citigroup maintains a Buy rating with a $220 price target.

The stock has a consensus “Moderate Buy” rating from 26 analysts, with an average 12-month price target of $225.04, suggesting potential upside. Therefore, Broadcom is considered a favourable investment choice in 2025.

Qes. Is Broadcom a Chinese company?

No, Broadcom is not a Chinese company. It is an American multinational corporation headquartered in San Jose, California.

conclusion:

In conclusion, Broadcom Inc. (AVGO) offers an appealing investment opportunity for Indian investors, with strong financial growth and a prominent role in AI and semiconductor technologies. Despite some market volatility and valuation concerns, its robust performance and strategic investments, including in India, make it a favourable option for 2025. However, investors should be mindful of currency and regulatory risks