Bandhan Bank, one of India’s fastest-growing private sector banks, has captured investor attention with its unique microfinance-led banking model and strong presence in underserved markets. Established in 2015 after transitioning from a microfinance institution (MFI), the bank has rapidly expanded its footprint, offering a wide range of retail banking, SME loans, and affordable housing finance solutions. With a focus on financial inclusion, Bandhan Bank serves millions of customers, particularly in rural and semi-urban areas, giving it a competitive edge in India’s evolving banking landscape.

Investors are keenly watching Bandhan Bank Share Price Target 2025-2030 due to its high-growth potential, improving asset quality, and digital transformation efforts. Despite facing challenges like rising NPAs in the past, the bank has shown resilience with strategic restructuring and a growing retail deposit base. As macroeconomic conditions stabilize and credit demand rises, analysts are optimistic about its long-term profitability, making it a compelling pick for both short-term traders and long-term investors.

This article explores Bandhan Bank Share Price Target 2025-2030, analyzing key growth drivers, risks, and expert predictions. Whether you’re a seasoned investor or a beginner, this guide will help you assess if Bandhan Bank aligns with your investment strategy and financial goals.

Bandhan Bank’s Current Performance (2023-2024 Snapshot)

Bandhan Bank’s stock has witnessed volatility in 2023-2024, reflecting both recovery hopes and lingering challenges. As of [Latest Date], the share price hovered between ₹180 (52-week low) and ₹280 (52-week high), indicating sensitivity to macroeconomic shifts and asset quality trends. The bank’s performance has been a mixed bag, with improving fundamentals but persistent concerns over NPAs—making it a high-risk, high-reward play for investors.

Key Financial Metrics (2023-2024)

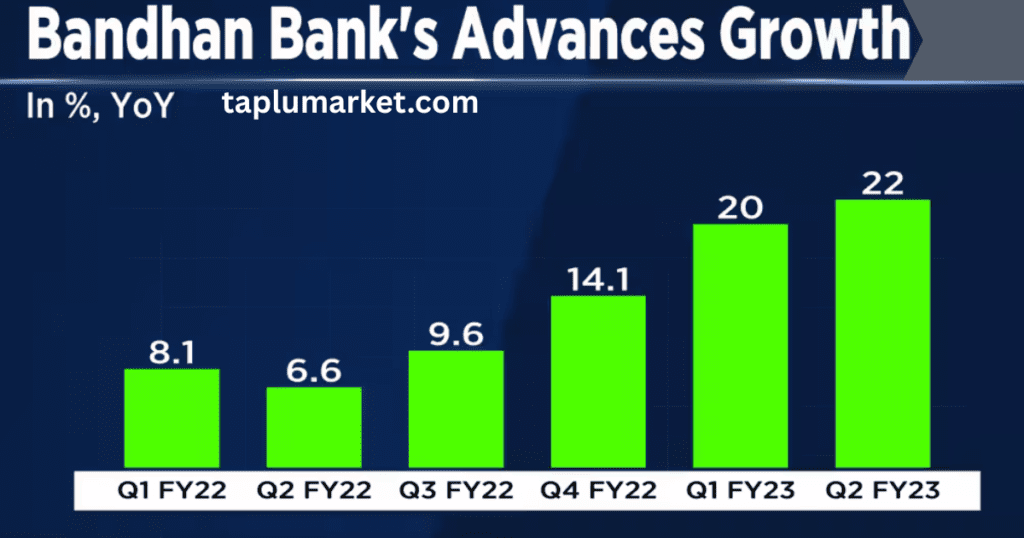

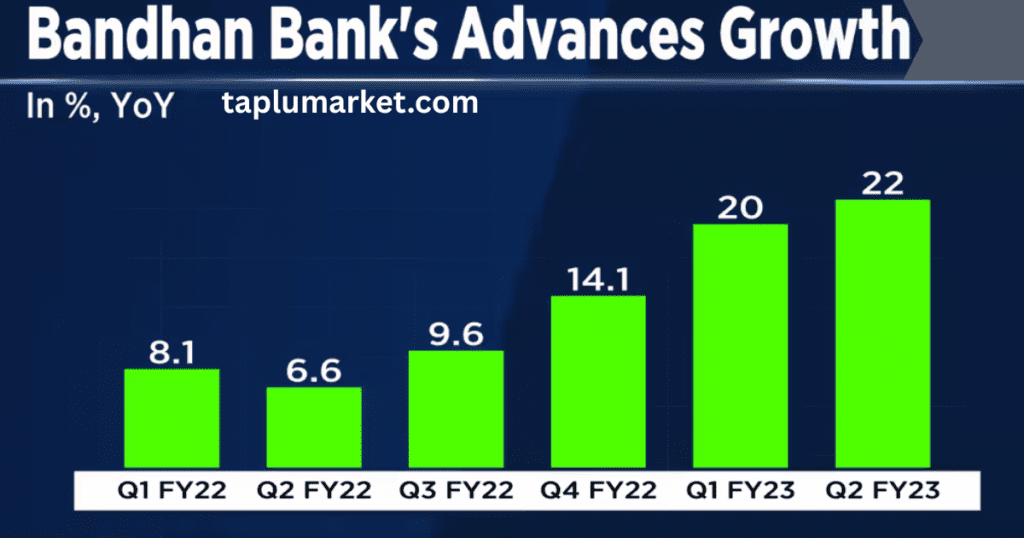

- Revenue Growth: Bandhan Bank reported a ~15% YoY increase in net interest income (NII), driven by loan book expansion in retail and microfinance.

- Profit After Tax (PAT): PAT showed moderate recovery (up ~10% YoY) after earlier setbacks, though margins remain under pressure.

- Net Interest Margin (NIM): NIMs stabilized near 7-8%, a healthy range, but higher funding costs could squeeze future profitability.

- Asset Quality (NPA Trends): Gross NPAs improved to ~7% (from ~10% in 2022), but slippages in the microfinance portfolio remain a key monitorable.

Market Sentiment & Analyst Ratings

- Bullish View: Analysts at [Brokerage Firms] cite strong rural demand, digital adoption, and declining credit costs as catalysts for re-rating.

- Bearish Concerns: Skeptics highlight exposure to unsecured loans, regulatory scrutiny, and competition from larger private banks.

- Consensus Rating: Majority of analysts maintain a “Hold” to “Buy” stance, with long-term price targets ranging ₹250–₹350 (12–18 months).

Bandhan Bank Share Price Target 2025: Growth Drivers & Predictions

As Bandhan Bank navigates post-pandemic recovery and evolving banking trends, its 2025 share price trajectory hinges on key growth catalysts and macroeconomic conditions. Here’s a detailed analysis of what investors can expect:

1. Short-Term Growth Drivers for 2025

A. Loan Book Expansion

- Microfinance & Retail Focus: Bandhan’s core strength lies in microloans and affordable housing finance, with plans to grow its retail loan portfolio by 15-20% YoY.

- SME Lending Push: Government schemes (e.g., PSB loans for MSMEs) and rising credit demand could boost SME loan disbursals.

- Rural Penetration: With 60%+ branches in semi-urban/rural areas, Bandhan is well-positioned to tap into India’s underbanked markets.

B. Digital Banking Growth

- Mobile Banking Adoption: Bandhan’s “Bandhan Mobile” app and UPI integrations aim to improve customer stickiness and low-cost deposits.

- Cost Efficiency: Digital processes may reduce operational costs, supporting NIM stability (current range: 7-8%).

C. Asset Quality Improvement

- Declining NPAs: Gross NPAs are projected to drop to ~5-6% by 2025 (vs. ~7% in 2024) if recovery trends hold.

- Provisioning Buffers: Higher provisioning coverage (currently ~75%) could cushion future shocks.

2. Analyst Predictions for 2025: Bullish vs. Bearish Scenarios

| Scenario | Price Target (₹) | Key Assumptions |

|---|---|---|

| Bullish Case | 300–350 | – Strong loan growth (20%+ YoY) – NIMs stabilize at 8%+ – Macroeconomic stability |

| Base Case | 250–300 | – Moderate NPA resolution – Steady 15% revenue growth |

| Bearish Case | 180–220 | – Rising competition from NBFCs – Economic slowdown impacts rural demand |

Consensus: Most analysts assign a 12-month target of ₹275–320 (15–25% upside from current levels).

3. Technical & Fundamental Outlook

Technical Analysis (2025 Projection)

- Support Levels: ₹200–220 (strong demand zone).

- Resistance Levels: ₹300 (psychological barrier; breakout could signal rally).

- Chart Patterns: Potential cup-and-handle formation on weekly charts, indicating bullish momentum if sustained.

Fundamental Valuation

- Price-to-Book (P/B): Current P/B of ~2.5x is below peers like HDFC Bank (3.8x), suggesting undervaluation if growth accelerates.

- ROE Improvement: Return on Equity (ROE) may rebound to 12–14% by 2025 (vs. 9–10% in 2024) if profitability rises.

Bandhan Bank Share Price Target 2026-2030: Mid to Long-Term Forecast

Bandhan Bank Share Price Target 2026-2027 (Mid-Term Outlook)

Key Growth Factors

✅ Retail & SME Lending Expansion

- Expected 18-22% CAGR in retail/SME loans due to rising financial inclusion.

- Government’s MSME support schemes (e.g., CGTMSE) to boost credit growth.

✅ Asset Quality Improvement

- Gross NPAs projected to decline to 4-5% (2026) if recovery trends hold.

- Stronger risk management & digitized collections to reduce slippages.

✅ Economic & Regulatory Impacts

- RBI Policies: Rate cuts (if inflation eases) could lower funding costs.

- Macroeconomic Trends: Rural income growth & infrastructure spending to drive demand.

Expected Price Range (2026-2027)

| Scenario | Price Target (₹) | Key Drivers |

|---|---|---|

| Optimistic | 350–450 | – Loan book grows at 20%+ CAGR – NIMs expand to 8.5%+ |

| Moderate | 300–350 | – Steady 15-18% loan growth – NPAs at 5% |

| Pessimistic | 220–280 | – Economic slowdown – Rising competition from fintechs |

Bandhan Bank Share Price Target 2028-2030 (Long-Term Outlook)

5-Year Growth Potential

🚀 Market Share Expansion

- Could capture 5-7% of India’s retail banking market (vs. ~3% today).

- Microfinance dominance to continue in East/Northeast India.

🚀 Digital Transformation

- AI-driven lending, UPI partnerships to improve efficiency.

- 30-40% of transactions expected via digital channels by 2030.

🚀 Rural Banking Penetration

- 60%+ branches in semi-urban/rural areas to drive sticky deposits.

Risks & Challenges

⚠️ Competition: Jio Financial, Paytm Bank, and NBFCs may disrupt growth.

⚠️ NPAs: Unsecured loans (~35% of book) remain a risk if macros worsen.

⚠️ Interest Rates: Prolonged high rates could squeeze NIMs.

Expert Predictions & Valuation (2030)

| Model | Price Target (₹) | Assumptions |

|---|---|---|

| DCF (Bull Case) | 600–800 | – 20% revenue CAGR – NIMs at 8.5% |

| PE-Based (Base Case) | 450–600 | – PE of 25x (vs. 18x today) – 15% earnings growth |

| Bear Case | 300–400 | – Slow NPA resolution – Market share loss |

Key Factors Influencing Bandhan Bank’s Share Price: Growth Catalysts vs. Risks

Bandhan Bank’s stock trajectory depends on a mix of unique strengths and sector-wide challenges. Here’s a balanced analysis to guide investors:

Key Factors Driving Bandhan Bank’s Share Price

✅ Positive Catalysts

1. Strong Rural & Microfinance Presence

- Market Leadership: Controls ~20% of India’s microfinance market, with deep roots in East/Northeast India.

- High-Growth Segment: Rural credit demand growing at 18-20% CAGR (vs. 12-14% urban).

2. Digital Banking Adoption

- Cost Efficiency: Digital transactions now ~30% of total, reducing operational costs.

- App-Based Growth: “Bandhan Mobile” app users doubled since 2022, improving low-cost CASA deposits.

3. Improving Asset Quality

- Declining NPAs: Gross NPAs fell from 10.8% (2022) to ~7% (2024); target of <5% by 2026.

- Provisioning Coverage: Improved to 75%+ (vs. 60% in 2021), reducing future risks.

⚠️ Risks to Consider

1. High Exposure to Unsecured Loans

- 35% of loans are unsecured (microfinance/SME). Economic downturns could spike defaults.

2. Regulatory Changes

- RBI’s Stricter MFI Norms: Capital requirements or lending caps may limit growth.

- PSL Compliance: Must meet priority-sector targets, which can pressure margins.

3. Economic Slowdown Impact

- Rural Stress: Poor monsoons or job losses could hurt repayment capacity.

- Competition: Jio Financial, small finance banks, and fintechs eating into market share.

Should You Invest in Bandhan Bank for the Long Term?

Who Should Invest?

- Aggressive Investors: High-risk tolerance, 5–7 year horizon.

- Believers in Rural Growth: Those bullish on India’s underbanked markets.

- Avoid If: You prefer stable dividends or low-volatility stocks.

Alternative Banking Stocks to Compare

| Stock | Key Strength | Risk | Best For |

|---|---|---|---|

| HDFC Bank | Stable NIMs (~4%), strong brand | Slow rural penetration | Low-risk investors |

| ICICI Bank | Digital leader, diversified loans | High valuation (P/B 3.5x) | Balanced growth |

| Kotak Bank | Premium retail focus | Slower expansion | Conservative investors |

Conclusion:

Bandhan Bank presents a high-growth, high-risk opportunity, with price targets ranging from ₹250 (bear case) to ₹800 (bull case) by 2030, driven by rural lending, digital adoption, and improving asset quality. However, risks like unsecured loan exposure, regulatory changes, and competition demand cautious optimism.

Disclaimer:

The advice or opinions given on Taplumarket are the personal views of the expert, the brokerage firm, the website or management is not responsible for it. Before investing, please consult your financial advisor or certified expert.