Introduction

Brent Crude, a major global benchmark for oil prices, plays a pivotal role in shaping energy markets, economic policies, and investment strategies worldwide. Extracted from the North Sea, it serves as a key pricing reference for nearly two-thirds of the world’s internationally traded crude oil, influencing everything from gasoline prices to inflation rates. As we look ahead to Brent Crude Price Target 2025, forecasting Brent Crude prices becomes crucial for investors, traders, and businesses—helping them navigate risks, optimise portfolios, and make informed decisions in an increasingly volatile energy landscape.

Recent years have seen extreme price swings, from the pandemic-driven collapse in 2020 to the surge following geopolitical tensions like the Russia-Ukraine war. With OPEC+ supply cuts, shifting demand from emerging markets, and the accelerating energy transition, 2025 could bring new disruptions—or unexpected stability. Will prices climb amid tightening supply, or will recession fears and green energy adoption push them lower? In this analysis, we break down expert forecasts, key market drivers, and strategic insights to help you stay ahead in the evolving oil market.

Current Brent Crude Price Trends (2023-2024): Key Drivers & Market Shifts

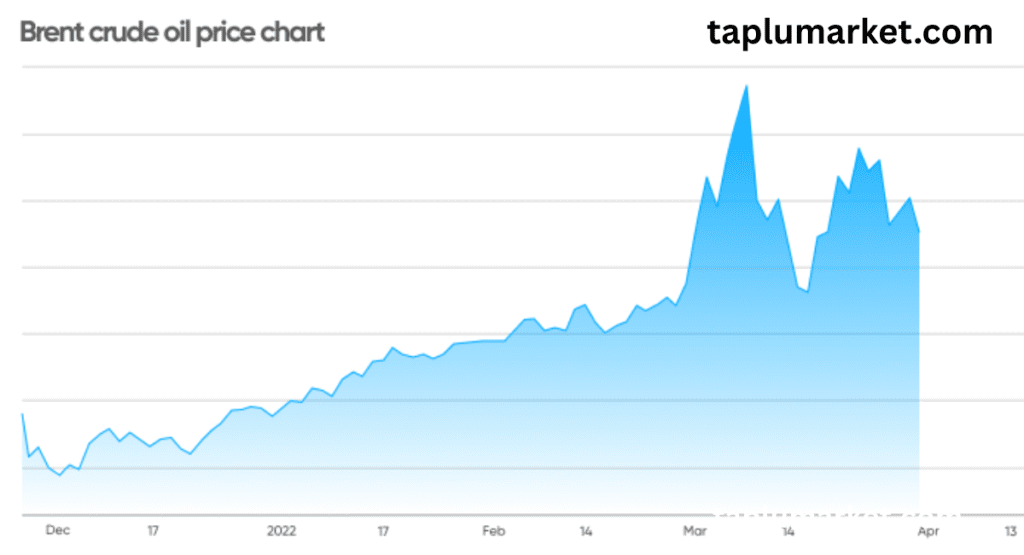

The Brent Crude oil price has experienced significant volatility between 2023 and mid-2024, reflecting a complex interplay of geopolitical tensions, OPEC+ supply policies, and fluctuating global demand. After averaging around 80−80−85 per barrel in 2023, prices saw sharp swings—briefly touching $95+ in late 2023 due to production cuts before easing back amid economic uncertainty.

Major Factors Influencing Recent Prices:

- OPEC+ Supply Cuts & Production Policies

- Strategic output reductions by Saudi Arabia and Russia in 2023-2024 tightened supply, pushing prices upward.

- OPEC+’s extended voluntary cuts (1.2+ million barrels/day) into 2024 signaled efforts to stabilize prices above $80.

- Global Demand Uncertainty

- China’s uneven post-pandemic recovery dampened oil demand growth, while U.S. and European consumption remained resilient.

- Rising interest rates and recession fears in 2023-2024 pressured prices, with traders weighing economic slowdown risks.

- Geopolitical Tensions & Supply Disruptions

- The Russia-Ukraine war continued to disrupt energy flows, particularly to Europe.

- Middle East conflicts (e.g., Red Sea shipping attacks, Israel-Hamas war) raised concerns over supply chain stability.

- U.S. Shale & Non-OPEC Production

- Record U.S. oil output (13.3+ million barrels/day in 2024) partially offset OPEC+ cuts, capping price rallies.

- However, slowing shale investment and rising extraction costs hinted at future supply constraints.

- Energy Transition Pressures

- Growing EV adoption and renewable energy investments weighed on long-term oil demand projections, though short-term reliance on fossil fuels persisted.

Brent Crude Price Forecast for 2025: Expert Predictions & Market Scenarios

(Read exclusive investment updates on TapluMarket.com)

As global energy markets brace for 2025, analysts are divided on where Brent Crude Price Target 2025 will land. Predictions range from bullish surges driven by tightening supply to bearish slumps tied to economic slowdowns. Here’s a breakdown of the three most likely scenarios, backed by expert insights and key market drivers:

1. Bullish Scenario: Prices Surge Above $90

(Potential Range: 90–90–110 per barrel)

Why Prices Could Rise Sharply:

- Supply Constraints: OPEC+ may extend or deepen production cuts to counterbalance declining spare capacity and underinvestment in new oil projects.

- Geopolitical Flashpoints: Escalation in Middle East conflicts (e.g., Iran-Israel tensions) or renewed Russia-Ukraine disruptions could threaten global supply.

- Stronger Demand: Resilient U.S. economic growth or a rebound in China’s industrial activity could push demand beyond expectations.

- Dollar Weakness: A depreciating U.S. dollar (if Fed cuts rates) typically lifts dollar-denominated oil prices.

Who’s Predicting This?

- Goldman Sachs: Forecasts 90–90–100 in 2025, citing structural supply deficits.

- JP Morgan: Warns of potential spikes to $110 if geopolitical risks intensify.

2. Bearish Scenario: Prices Drop Below $80

(Potential Range: 60–60–75 per barrel)

Why Prices Could Fall:

- Global Recession: A prolonged economic downturn in the U.S. or EU could slash oil demand.

- Alternative Energy Growth: Faster-than-expected EV adoption or renewable energy breakthroughs may reduce fossil fuel reliance.

- U.S. Shale Surge: If shale producers ramp up drilling (e.g., at $80+ prices), oversupply could crash markets.

- OPEC+ Discipline Collapse: Internal disagreements leading to cheating on quotas or a production war.

Who’s Warning of This?

- Bank of America: Sees risk of 60–60–70 if recession hits.

- IEA: Highlights peak oil demand by 2030, with 2025 demand growth potentially stalling.

3. Base Case (Consensus View): Moderate Stability

(Potential Range: 80–80–90 per barrel)

Balanced Market Assumptions:

- OPEC+ maintains gradual cuts while U.S. shale grows modestly.

- Demand grows ~1-1.5% yearly, led by emerging markets.

- Geopolitics remain “noisy but contained” (e.g., no major supply shocks).

Institutional Forecasts:

- EIA (U.S. Energy Info Administration): Projects 82–82–88 for 2025.

- Reuters Poll: Median analyst estimate at $85.

Key Factors Influencing Brent Crude Prices in 2025: What Will Drive the Market?

The Brent Crude Price Target 2025 will be shaped by a complex mix of geopolitical, economic, and industry-specific forces. Below, we break down the six most critical factors that could push oil prices higher or lower—along with expert insights on what to watch.

(Read exclusive investment updates on TapluMarket.com)

1. Geopolitical Risks: The Wildcard for Oil Prices

(Middle East, Russia-Ukraine, US-China Relations)

| Risk Factor | Potential Impact on Brent Crude 2025 |

|---|---|

| Middle East Tensions (Iran, Israel, Red Sea) | Supply disruptions could spike prices +10–10–15/barrel |

| Russia-Ukraine War Escalation | Further sanctions may reduce Russian exports, tightening supply |

| US-China Trade Conflicts | Tariffs or tech bans could slow global growth, denting oil demand |

Why It Matters:

- 25% of global oil trade flows through the Middle East—any conflict risks immediate price shocks.

- The Russia-Ukraine war has already rerouted 1-2 million barrels/day of supply since 2022.

2. Economic Growth & Inflation: Demand Drivers

(Global GDP, Interest Rates, Recession Risks)

| Scenario | Brent Crude Price Impact |

|---|---|

| Strong Global GDP (>3%) | Demand surge → 85–85–95/barrel |

| Recession (GDP <2%) | Oil demand drop → 60–60–75/barrel |

| High Inflation + Rate Cuts | Weak dollar → supports higher oil prices |

Key Insight:

- The IMF forecasts 3.1% global growth in 2025—but a U.S. or EU recession could derail this.

3. OPEC+ Production Policies: The Supply Control Lever

(Will Cuts Continue or Ease?)

- Current Policy: 1.2 million bpd cuts extended into 2024.

- 2025 Outlook:

- If cuts hold → Prices $85+

- If OPEC+ floods market → Prices crash to $70s

Who Decides? Saudi Arabia and Russia hold the most sway—watch for November 2024 OPEC meeting.

4. Energy Transition: Renewables & EVs

(Will Green Policies Slow Oil Demand?)

| Trend | Impact on 2025 Oil Prices |

|---|---|

| Faster EV Adoption (20%+ global sales) | Could reduce oil demand 1–2 million bpd |

| Renewables Growth | Solar/wind may displace fossil power generation |

| Climate Policies | Stricter emissions rules cap long-term demand |

Reality Check: Even in aggressive transition scenarios, oil demand remains strong in aviation/shipping.

5. US Shale Production: The Swing Factor

(Can Fracking Fill the Gap?)

- 2024 Output: ~13.3 million bpd (near record highs).

- 2025 Risks:

- Declining well productivity → Higher breakeven costs (65–65–75/barrel).

- Investor pressure to limit drilling → Supply growth slows.

Takeaway: If Brent stays above $80, shale may keep growing—capping price rallies.

6. US Dollar Strength: The Inverse Relationship

(Strong Dollar = Cheaper Oil, and Vice Versa)

- If Fed cuts rates in 2025 → Dollar weakens → oil prices rise.

- If inflation stays high → Strong dollar → oil prices face pressure.

Data Point: A 10% drop in the USD Index historically lifts oil ~5–8%.

Historical Brent Crude Price Analysis: Lessons for 2025 Forecasts

To predict the Brent Crude Price Target 2025, we must examine past trends, crashes, and recoveries. Over the last decade, oil prices have experienced extreme volatility—from supply gluts to demand shocks—offering critical insights for future forecasts.

(Read exclusive investment updates on TapluMarket.com)

Key Price Cycles (2014–2024) & Their Drivers

| Period | Price Range | Major Events | Lessons for 2025 |

|---|---|---|---|

| 2014–2016 | 115→115→28 | – US shale boom floods market – OPEC abandons production cuts | Oversupply crashes prices—OPEC+ now actively manages supply |

| 2020 Pandemic | 65→65→19 | – COVID lockdowns slash demand – Negative oil prices (WTI) briefly | Demand shocks matter more than supply—economic health is key |

| 2022–2023 | 75→75→120+ | – Russia-Ukraine war disrupts supply – OPEC+ cuts deepen shortages | Geopolitics can spike prices rapidly—risk hedging is critical |

| 2024 (YTD) | 75–75–90 | – OPEC+ extends cuts – Mixed China demand, strong US shale | Balanced markets keep prices range-bound—unless shocks occur |

3 Critical Lessons for 2025 Forecasts

1. Supply-Demand Imbalances Cause Extreme Swings

- 2014–2016: Prices crashed when US shale oversupply met OPEC’s refusal to cut.

- 2020: Demand vanished overnight, proving no market is immune to black swans.

- 2025 Takeaway: Watch for US shale responsiveness + OPEC+ discipline.

2. Geopolitics Can Override Fundamentals

- 2022’s Russia-Ukraine war sent prices soaring +40% in weeks, despite stable fundamentals.

- 2025 Risk: Escalation in Middle East (Iran, Israel) or Russia could repeat this.

3. The Energy Transition Is Slowly Reshaping Markets

- EV adoption & renewables grew steadily but haven’t yet killed oil demand.

- 2025 Reality: Oil remains vital for transport/industry, but long-term demand peaks loom.

How Traders & Investors Can Use This Data

- Compare 2025 forecasts to past cycles—are current assumptions too optimistic/pessimistic?

- Watch for repeating patterns:

- OPEC+ vs. shale standoffs → 2014-like crashes possible if cooperation breaks.

- Sudden demand drops → Pandemic-style collapses remain a risk.

- Hedge against volatility—options, diversified energy portfolios.

Brent Crude Price Target 2025: Historical Context

✅ 2014–2016 = Warning on unchecked supply growth.

✅ 2020 = Proof that demand shocks hurt more than supply.

✅ 2022–2023 = Geopolitics trump all in the short term.

How Investors & Businesses Can Prepare for Brent Crude Price Shifts in 2025

With Brent Crude prices facing uncertainty in 2025, businesses and investors must adapt to volatility, geopolitical risks, and the energy transition. Below, we break down actionable strategies for different stakeholders—from oil-dependent industries to active traders—and explore the long-term risks of fossil fuels vs. green energy.

1. Strategies for Oil-Dependent Industries

(Airlines, Shipping, Petrochemicals, Manufacturing)

Short-Term Hedging Strategies

| Tool | How It Helps | Best For |

|---|---|---|

| Futures Contracts | Lock in prices to avoid spikes | Airlines, trucking |

| Options (Calls/Puts) | Limit downside while keeping upside | Refiners, chemical firms |

| Supplier Agreements | Fixed-price contracts with producers | Industrial buyers |

Long-Term Adaptation

- Diversify Energy Sources: Blend biofuels, LNG, or electrification where possible.

- Efficiency Upgrades: Reduce fuel consumption via logistics optimization.

- Carbon Offsets: Prepare for stricter emissions regulations.

Case Study: Delta Airlines saved $300M/year via fuel hedging post-2014 oil crash.

2. Opportunities for Traders & Investors

(Crude Oil Futures, ETFs, Energy Stocks)

Best Instruments to Trade Oil in 2025

| Asset | Pros | Cons | Key 2025 Consideration |

|---|---|---|---|

| Brent Futures (ICE) | Direct price exposure | High volatility | Watch OPEC+ meetings |

| Energy ETFs (XLE, USO) | Diversified, liquid | Management fees | Rising renewables weight |

| Oil Majors (SHEL, XOM) | Dividends, stability | Transition risks | Capex shifts to green energy |

| Shale Stocks (PXD, COP) | Leveraged to oil prices | Debt concerns | Breakeven prices ~$65 |

Trading Strategies for 2025

- Range Trading: If Brent stays 80–80–90, sell highs, buy lows.

- Geopolitical Plays: Buy calls ahead of Middle East tensions.

- Contrarian Bet: Short oil if recession fears spike.

3. Long-Term Risks: Fossil Fuels vs. Green Energy Shift

Risks of Over-Reliance on Oil

| Risk Factor | 2025 Impact | Mitigation |

|---|---|---|

| Demand Peaks | IEA predicts plateau by 2030 | Diversify into gas/renewables |

| Regulatory Shifts | Carbon taxes, drilling bans | Invest in carbon capture |

| Stranded Assets | Oil reserves may lose value | Shift capital to renewables |

Green Energy Opportunities

- Renewable Stocks (NextEra, Enphase) – Solar/wind growth plays.

- EV & Battery Metals (Lithium, Copper) – Tesla, Albemarle, Freeport.

- Hydrogen ETFs (HYDR, ICLN) – Emerging clean fuel alternative.

Stat: Global EV sales hit 17M in 2024—up 35% YoY, pressuring oil demand.

Conclusion:

The Brent Crude price target for 2025 hinges on a delicate balance of geopolitical risks, OPEC+ decisions, economic trends, and energy transition shifts. While expert predictions vary—from 60inabearishrecessionscenarioto60inabearishrecessionscenarioto110+ amid supply shocks—the key for investors and businesses is preparation, not prediction.

Key Takeaways:

✔ Geopolitics & OPEC+ supply policies will dominate short-term price swings.

✔ Economic health (GDP, interest rates) determines demand strength.

✔ Energy transition pressures are growing but won’t erase oil’s role yet.

✔ Hedging (futures, options) and diversification (ETFs, renewables) mitigate risks.

Final Thought: Oil markets remain volatile and unpredictable, but by tracking supply shifts, demand signals, and geopolitical developments, you can make smarter decisions—whether you’re trading crude futures, managing fuel costs, or investing in energy stocks. Stay agile, stay informed, and adapt as 2025 unfolds.

Disclaimer:

The advice or opinions given on Taplumarket are the personal views of the expert, the brokerage firm, the website or management is not responsible for it. Before investing, please consult your financial advisor or certified expert.