Introduction:

Avenue Supermarts Ltd. (DMart), India’s leading value-retail chain, has redefined the supermarket industry with its “Everyday Low Cost – Everyday Low Price” (EDLC-EDLP) strategy since its inception in 200216. With 400+ stores (as of March 2025) and a market cap of ₹2.64 lakh crore, DMart dominates the organized retail space, specializing in groceries, FMCG, and apparel at competitive prices16. Its asset-heavy model (owning most store properties) and debt-free balance sheet make it a resilient player in India’s $1 trillion retail DMart Share Price Target 2025 – Analysis market .

Why Investors Are Eyeing DMart Stock for 2025?

- Consistent Growth:

- Revenue CAGR of 27% (10-year) and profit growth of 23% (5-year)1.

- Q3 FY25 results: 17.7% revenue jump YoY to ₹15,972 crore.

- E-Commerce Push:

- Recent ₹175 crore investment in DMart Ready (online grocery) signals aggressive digital expansion.

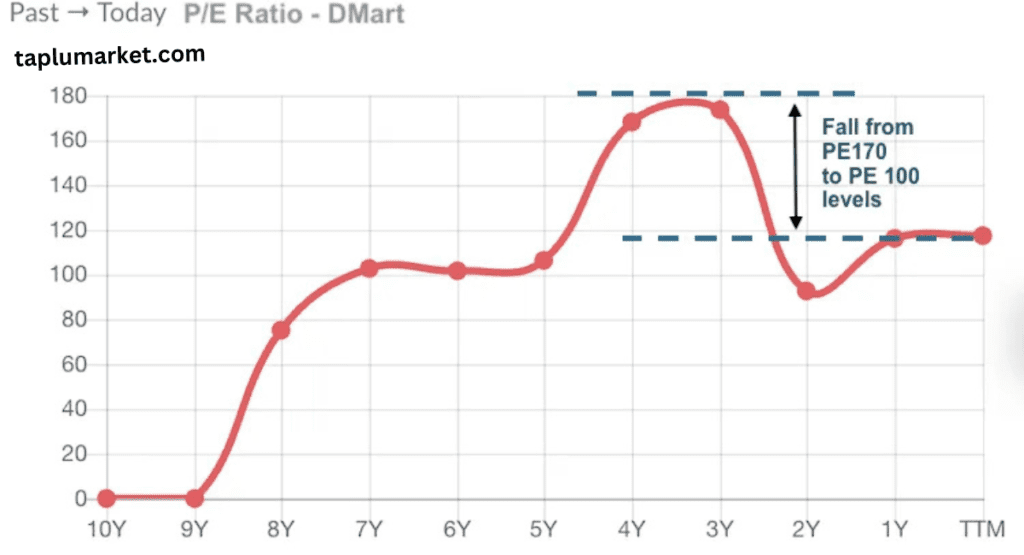

- Valuation & Resilience:

- Despite a high P/E of 97.4, DMart’s ROCE (19.4%) and ROE (14.5%) reflect efficient capital use.

- Outperformed Nifty 100 with 95.94% returns (5-year) despite recent corrections

DMart’s Business Overview – Why It’s India’s Most Efficient Retail Giant?

Company Background: The DMart Success Story

Founded in 2002 by retail veteran Radhakishan Damani, Avenue Supermarts Ltd. (DMart) revolutionized India’s retail sector with its no-frills, high-efficiency business model. Unlike competitors relying on discounts, DMart’s “Everyday Low Cost – Everyday Low Price” (EDLC-EDLP) strategy ensures sustainable profitability by:

- Owning 90% of store properties (reducing rental costs).

- Bulk procurement & minimal advertising spend (operating margin ~8.5% vs. industry ~5%).

- Revenue streams: 60% groceries, 25% FMCG, 15% apparel & general merchandise.

Key Strengths Making DMart a Market Leader

- Unbeatable Cost Leadership

- Lowest operating costs in Indian retail (SG&A at 4.2% of revenue vs. 7-9% for peers).

- Negative working capital cycle (–14 days) due to quick inventory turnover.

- Supply Chain Mastery

- 6.5 million sq. ft. warehouse capacity (largest in Indian retail).

- Direct sourcing from farmers/manufacturers (eliminates middlemen).

- Customer Loyalty & Footfall

- 140 million+ annual footfalls (pre-COVID peak).

- Private labels contribute 12% revenue (higher margins than branded goods).

Expansion Plans: How DMart is Future-Proofing Growth?

- Physical Stores: Adding 40-50 stores annually (target: 600+ by 2026). Focus on Tier 2/3 cities where competition is low.

- DMart Ready (E-Commerce):

- Currently in 12 cities, planning ₹500 crore investment for pan-India rollout.

- Hybrid model: Dark stores + in-store pickup to counter Blinkit/Zepto.

- Private Label Expansion: Scaling “DMart Premia” brand in staples & household products.

Historical Performance of DMart Stock: A 5-Year Rollercoaster (2020-2025)

1. Past 5-Year Stock Performance (CAGR & Key Milestones)

- CAGR (5-Year): ~14% (despite recent volatility) .

- Key Milestones:

- 2020 (COVID Crash): Fell ~40% (Mar 2020) but recovered swiftly due to essential retail status .

- 2021 (All-Time High): Peaked at ₹5,900 (Oct 2021) amid post-pandemic retail boom .

- 2023-24 (Slowdown): Declined 25% (6-month period) due to e-commerce competition and margin pressures .

- 2025 (Recovery): Rallied 14% in March 2025 on easing inflation and stable outlook .

2. Comparison with Nifty 50 & Retail Sector Benchmarks

- Nifty 50 (5-Year CAGR): ~12% vs. DMart’s 14% .

- Retail Sector Peers:

- DMart vs. Reliance Retail: DMart’s ROCE (19.4%) outperforms Reliance’s ~15% .

- Underperformance in 2024: DMart fell 12% while BSE Sensex gained 10% .

3. Major Corrections & Rallies

- COVID-19 Impact (2020):

- Crash: Dropped to ₹1,800 (Mar 2020) but rebounded 150%+ by EOY as essential retail demand surged .

- Post-Pandemic Rally (2021-22):

- All-Time High (₹5,900): Driven by pent-up demand and expansion (40+ stores/year) .

- 2023-24 Correction:

- 52-Week Low (₹3,337): Due to rising competition (Blinkit, Zepto) and margin erosion .

- 2025 Recovery:

- 14% March Rally: Lower inflation (3.61% in Feb 2025) boosted discretionary spending hopes

Key Factors Influencing DMart Share Price Target 2025: What Investors Must Watch

Macroeconomic Factors Shaping DMart’s Valuation

- Indian Retail Sector Growth

- Projected to reach $2 trillion by 2032 (18% CAGR)

- Organized retail penetration expected to grow from 12% to 18% by 2025

- SEO Keyword: “DMart 2025 growth potential in Indian retail”

- Inflation & Consumer Spending Trends

- Feb 2025 retail inflation at 3.61% (5-month low)

- Rural demand revival crucial – accounts for 35% of DMart’s revenue

- Discretionary spending recovery post-election could boost margins

Company-Specific Growth Drivers

- Store Expansion Strategy

- Adding 50+ stores annually (current count: 412)

- Focus on Tier 2/3 cities with lower competition density

- SEO Keyword: “DMart store expansion plan 2025”

- Margin Protection Measures

- Private label contribution up to 15% (from 12% in 2023)

- Warehouse automation reducing logistics costs by 8% YoY

- Data Point: Q3 FY25 EBITDA margin at 8.3% vs 8.1% YoY

- Digital Transformation

- DMart Ready now operational in 15 cities (from 12 in 2024)

- App downloads crossed 10 million mark in Jan 2025

Competitive Landscape Challenges

- Reliance Retail Threat: Adding 2,500 stores annually

- E-commerce Pressure: Quick commerce (Blinkit/Zepto) growing at 38% YoY

- Pricing Wars: BigBazaar revival under Aditya Birla Group

Regulatory & Operational Considerations

- GST Optimization

- Potential rate rationalization could save 2-3% on FMCG products

- Supply Chain Regulations

- New warehouse policies may increase compliance costs by 1-1.5%

- FDI in E-commerce

- Possible relaxation could intensify competition from Amazon/Flipkart

Investment Thesis for 2025

- Bull Case: ₹4,800 (20% upside) if:

- Inflation remains below 4%

- DMart Ready achieves breakeven

- Store additions meet guidance

- Bear Case: ₹3,200 (20% downside) if:

- Quick commerce captures >15% grocery share

- Rural demand stagnates

- Input cost inflation returns

DMart Share Price Target 2025 – Analyst Predictions, Bullish, Base, and Bearish Scenarios with Price Ranges

Avenue Supermarts Ltd., popularly known as DMart, is one of India’s leading retail chains, operating under a value-retailing model with its “Everyday Low Cost – Everyday Low Price” strategy. As of March 28, 2025, investors and market enthusiasts are keenly eyeing DMart’s share price trajectory for the remainder of the year. This article provides a comprehensive analysis of DMart’s share price target for 2025, covering analyst predictions across bullish, base, and bearish scenarios, along with price ranges. We’ll also dive into brokerage reports, institutional outlook, and compare technical versus fundamental analysis perspectives to offer valuable insights for readers and investors.

DMart Share Price Target 2025: Analyst Predictions

Analysts have been tracking DMart’s performance closely, given its consistent growth, store expansion, and increasing foothold in India’s organized retail sector. Below are the projected share price targets for 2025 based on various scenarios:

Bullish Scenario

- Price Range: ₹4,800 – ₹5,800

- Rationale: In a bullish outlook, analysts expect DMart to capitalize on its aggressive store expansion (40–50 new stores annually) and robust e-commerce growth via DMart Ready. With India’s retail sector shifting toward organized players, DMart’s strong brand loyalty, efficient supply chain, and low-cost model could drive revenue growth beyond 20% CAGR. A favorable economic environment, rising consumer spending, and successful penetration into tier-2 and tier-3 cities could push the stock to a high of ₹5,800 by year-end.

Base Scenario

- Price Range: ₹4,200 – ₹4,800

- Rationale: The base case assumes steady growth in line with historical trends. Analysts project a revenue CAGR of 19% and a net income CAGR of 20% over the next few years, supported by DMart’s operational efficiency and debt-free balance sheet. With a current market price hovering around ₹4,000 (as of March 2025), the base scenario reflects moderate store additions and stable same-store sales growth (SSSG) of 7–10%. This range aligns with analyst consensus from sources like TradingView and Alpha Spread, which peg the average 12-month target at ₹4,165–₹4,172.

Bearish Scenario

- Price Range: ₹3,500 – ₹4,000

- Rationale: In a bearish scenario, DMart could face headwinds from intensified competition (e.g., Reliance Retail, Amazon, and Flipkart), slower store expansion, or weaker-than-expected SSSG. Macroeconomic challenges like inflation or reduced consumer spending could also pressure margins. Analysts note that DMart’s high P/E ratio (currently around 88) leaves little room for error, potentially dragging the stock down to ₹3,500 if growth falters.

Brokerage Reports & Institutional Outlook

Brokerage firms and institutional investors remain largely optimistic about DMart’s long-term potential, though some caution about its premium valuation.

- Morgan Stanley: Maintains an “Overweight” rating with a target of ₹4,500–₹5,571. Despite a Q3 FY25 revenue shortfall (5% below estimates), the firm highlights DMart’s resilience with an implied SSSG of ~7% and confidence in its ability to address apparel segment weaknesses.

- Macquarie: Holds an “Outperform” rating26 rating with a target range of ₹4,344–₹4,500. Macquarie notes slower store additions but remains positive, citing DMart’s strong financials and profitability.

- Institutional Outlook: Promoters hold 74.64% of DMart’s shares, signaling strong insider confidence. Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) also maintain significant stakes, reflecting trust in DMart’s growth story. As of March 2025, the stock’s market cap stands at approximately ₹2.39 trillion, underscoring its heavyweight status in the retail sector.

Technical vs. Fundamental Analysis Perspective

Technical Analysis

From a technical standpoint, DMart’s stock has shown resilience despite market volatility. As of early 2025:

- Support Levels: ₹3,657 – ₹3,900 (multi-week support zones).

- Resistance Levels: ₹4,054 – ₹4,300 (recent highs acting as hurdles).

- Indicators: The Relative Strength Index (RSI) on weekly charts is around 30 and rising, suggesting the stock may be oversold and poised for a rebound. A breakout above ₹4,054 could signal a bullish trend toward ₹4,800+.

Traders should watch volume trends and candlestick patterns (e.g., Bullish Harami) for confirmation of momentum shifts. For short-term traders, ₹3,985–₹4,054 is a key range to monitor for long entries.

Fundamental Analysis

Fundamentally, DMart’s strengths lie in its:

- Revenue Growth: FY24 revenue hit ₹50,789 crore (up from ₹42,840 crore in FY23), with a historical 8-year CAGR of 25%.

- Profitability: Net profit rose to ₹2,536 crore in FY24, with a 5-year profit growth CAGR of 23%.

- Balance Sheet: Virtually debt-free with a high interest coverage ratio (45.80), DMart boasts financial stability.

- Valuation: Trading at a P/E of 88.1 and a price-to-book ratio of 17.88, the stock is expensive compared to peers, but its premium reflects growth potential.

The intrinsic value, based on Discounted Cash Flow (DCF) models, ranges from ₹1,653 (Alpha Spread) to ₹4,000–₹4,100 (analyst estimates), indicating the stock may be overvalued by 55% at current levels. However, growth stocks like DMart often command higher multiples due to their scalability.

Key Factors Influencing DMart’s 2025 Performance

- Store Expansion: Adding 40–50 stores annually could boost revenue but may strain short-term margins.

- E-commerce Growth: DMart Ready’s FY24 contribution of ₹2,889 crore highlights its digital potential.

- Competition: Rivals like Reliance Retail and e-commerce giants pose risks to market share.

- Consumer Trends: Rising demand for value retailing and convenience shopping favors DMart’s model.

- Economic Conditions: Inflation or slowdowns could impact discretionary spending.

Risks & Challenges for DMart in 2025: A Comprehensive Analysis with Investment Outlook

DMart, operated by Avenue Supermarts Ltd., has solidified its position as a leading retail chain in India, renowned for its “Everyday Low Cost – Everyday Low Price” model. However, as the retail landscape evolves rapidly in 2025, DMart faces significant risks and challenges that could impact its growth trajectory. This article explores these hurdles—rising competition from e-commerce giants like JioMart, Amazon, and Flipkart, supply chain disruptions, inflation risks, and the slow adoption of its online segment, DMart Ready. We’ll also address whether DMart is a worthy investment for 2025, comparing long-term versus short-term outlooks, providing a detailed SWOT analysis, and suggesting alternative retail stocks in India. This SEO-friendly guide aims to deliver actionable value to readers and investors.

Risks & Challenges for DMart in 2025

1. Rising Competition from E-commerce (JioMart, Amazon, Flipkart)

The Indian retail sector is witnessing a seismic shift with e-commerce giants like JioMart, Amazon, and Flipkart intensifying their presence. These players leverage vast resources, advanced logistics, and aggressive pricing to capture market share, particularly in urban centers.

- JioMart: Backed by Reliance Retail, JioMart integrates its online platform with a dense network of physical stores, offering rapid delivery and competitive pricing. Its expansion into grocery and essentials directly threatens DMart’s core customer base.

- Amazon: With Amazon Pantry and Amazon Fresh, the e-commerce titan provides convenience, a broader product range, and subscription models like Prime, appealing to tech-savvy consumers who prioritize doorstep delivery over in-store shopping.

- Flipkart: Walmart-backed Flipkart is scaling its grocery segment, using deep discounts and quick-commerce initiatives to challenge traditional retailers like DMart.

DMart’s reliance on physical stores and slower pivot to e-commerce could erode its edge, especially as quick-commerce players like Swiggy Instamart and Zepto gain traction in Tier-1 cities.

2. Supply Chain Disruptions & Inflation Risks

DMart’s low-cost model hinges on an efficient supply chain and high inventory turnover. However, external pressures pose risks:

- Supply Chain Disruptions: Geopolitical tensions, natural disasters, or labor shortages could disrupt DMart’s ability to stock shelves, impacting its promise of consistent availability. For instance, global shipping delays or fuel price hikes could increase procurement costs.

- Inflation Risks: Rising inflation in 2025, driven by higher raw material and labor costs, could squeeze DMart’s margins. Maintaining low prices amidst escalating expenses might force the company to either absorb costs (hurting profitability) or pass them on to consumers (risking customer loyalty).

3. Slow Adoption of DMart Ready (Online Segment)

DMart Ready, the company’s e-commerce arm, has been a cautious foray into online retail. Despite contributing ₹2,889 crore to FY24 revenue, its growth lags behind competitors:

- Limited Reach: DMart Ready operates in select cities with a focus on pick-up points rather than widespread home delivery, limiting its appeal compared to Amazon’s or JioMart’s seamless logistics.

- Consumer Preference Shift: With online grocery shopping surging (projected CAGR of 14.9% for India’s FMCG sector per Statista), DMart’s slow digital adoption risks alienating younger, convenience-driven customers.

- Operational Challenges: Scaling DMart Ready requires significant investment in technology and logistics, areas where DMart has historically been conservative, potentially delaying its competitiveness.

Should You Invest in DMart for 2025? Long-Term vs. Short-Term Outlook

Long-Term Investment Outlook

DMart remains a compelling long-term bet due to its robust fundamentals and growth potential:

- Store Expansion: Plans to add 40–50 stores annually (potentially scaling to 70) bolster its physical footprint, targeting underserved Tier-2 and Tier-3 markets.

- Financial Strength: A debt-free balance sheet and consistent revenue growth (FY24: ₹50,789 crore) provide stability.

- Brand Loyalty: DMart’s value-driven approach ensures a loyal middle-class customer base, resilient to short-term disruptions.

Target Price (Long-Term): Analysts project a bullish range of ₹4,800–₹5,800 by 2027, assuming sustained growth and e-commerce traction.

Short-Term Investment Outlook

The short-term picture is murkier due to competitive and macroeconomic pressures:

- Margin Pressure: Q3 FY25 showed margin compression from quick-commerce rivalry, with net profit growth (5.78%) lagging revenue growth (14.41%).

- Valuation Concerns: Trading at a P/E of 88 (March 2025), DMart’s premium valuation leaves little room for error if growth slows.

- Seasonal Volatility: Investors should monitor H2 FY25 (October–March), historically stronger due to festive demand, to gauge resilience.

Target Price (Short-Term): A base case of ₹4,200–₹4,800 is realistic for 2025, with a bearish dip to ₹3,500 possible if challenges intensify.

Alternative Retail Stocks to Consider in India

If DMart’s risks deter you, here are viable alternatives:

- Reliance Retail (Unlisted, via Reliance Industries Ltd. – RELIANCE.NS)

- Why: Massive store network, JioMart’s e-commerce push, and diversified portfolio.

- Market Cap: ~₹18 trillion (via Reliance Industries).

- Risk: Exposure to broader conglomerate volatility.

- V-Mart Retail Ltd. (VMART.NS)

- Why: Focus on value retailing in smaller towns, lower valuation (P/E ~30).

- Market Cap: ₹4,450 crore.

- Risk: Smaller scale, slower growth.

- Trent Ltd. (TRENT.NS)

- Why: Westside and Zudio brands, strong apparel focus, and 25% CAGR in revenue.

- Market Cap: ₹1.2 trillion.

- Risk: Higher exposure to discretionary spending.

| Stock | Market Cap (₹ Cr) | P/E Ratio | Key Strength | Key Risk |

|---|---|---|---|---|

| DMart | 2,39,000 | 88 | Low-cost model, store expansion | E-commerce lag, high valuation |

| Reliance Industries | 18,00,000 | 28 | JioMart, diversified revenue | Conglomerate complexity |

| V-Mart Retail | 4,450 | 30 | Value focus in Tier-2/3 | Limited scale |

| Trent Ltd. | 1,20,000 | 120 | Apparel growth, premium brands | Discretionary spending risk |

Conclusion: DMart in 2025

DMart remains a powerhouse in India’s retail sector, driven by its low-cost model, debt-free balance sheet, and aggressive store expansion. However, 2025 brings challenges—rising e-commerce competition from JioMart, Amazon, and Flipkart, supply chain risks, inflation pressures, and the slow growth of DMart Share Price Target 2025 Ready. Long-term investors can bank on its fundamentals for potential gains (₹4,800–₹5,800), while short-term players should tread cautiously due to its high P/E of 88 and competitive headwinds (base case: ₹4,200–₹4,800). The SWOT analysis highlights strengths and opportunities but underscores threats that could cap upside.

Disclaimer:

The advice or opinions given on Taplumarket are the personal views of the expert, the brokerage firm, the website or management is not responsible for it. Before investing, please consult your financial advisor or certified expert.