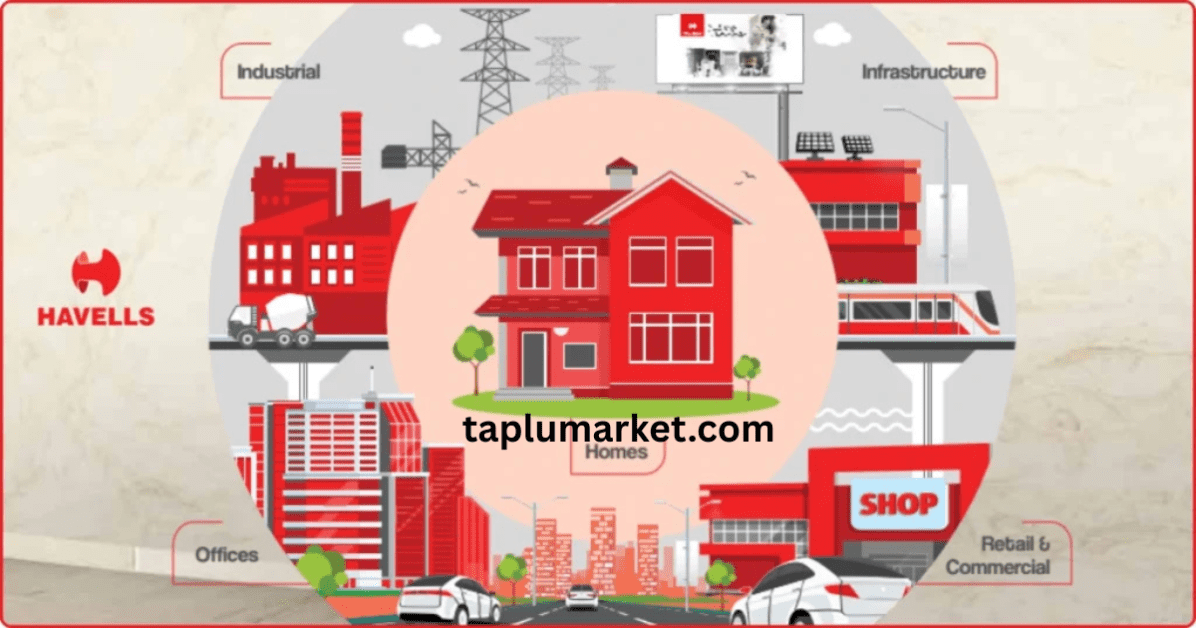

Havells India Ltd is one of India’s leading electrical equipment and consumer durable companies, with a strong presence across fans, lighting, switches, cables, air conditioners, and home appliances. Founded in 1958, the company has built a trusted brand reputation, backed by innovation, quality, and an extensive distribution network. With manufacturing facilities in India and global markets, Havells Share Price Target 2025-2030 has consistently demonstrated resilience in competitive sectors. It is a favorite among investors looking for stable electrical and consumer durables growth.

Investors are keenly watching Havells stock due to its consistent financial performance, strong domestic demand, and expansion into premium appliances like IoT-enabled smart devices. The company’s ability to adapt to market trends—such as energy-efficient products and government initiatives like “Make in India” and smart city projects—positions it well for long-term growth. Additionally, Havells’ low debt, healthy dividend payouts, and strong return ratios make it an attractive pick for both short-term traders and long-term investors.

The purpose of this article is to provide a data-driven, unbiased analysis of Havells Share Price Target 2025-2030, helping investors make informed decisions. Whether you’re a seasoned trader or a beginner, this guide will cover key growth drivers, risks, expert forecasts, and price projections to determine if Havells is a worthwhile addition to your portfolio.

Havells Share Price Performance – Historical Trends (2019-2024)

Over the past five years, Havells India Ltd has witnessed a mix of steady growth and volatility, reflecting broader market trends and sector-specific developments. Between 2019 and 2024, the stock saw significant movements influenced by economic cycles, consumer demand shifts, and competitive pressures.

Key Highlights of Havells’ Stock Performance (2019-2024):

- Pre-COVID (2019-early 2020): Havells traded in a range-bound pattern, with moderate growth driven by stable demand in electrical goods and expansion in the air conditioner (AC) and consumer appliances segment.

- COVID-19 Impact (2020-2021): Like most stocks, Havells faced a sharp decline in early 2020 due to lockdowns and supply chain disruptions. However, it rebounded strongly in late 2020 and 2021 as pent-up demand, rural electrification, and work-from-home trends boosted sales of fans, appliances, and wiring products.

- Post-Pandemic Recovery (2022-2023): The stock saw consistent upward momentum, supported by Havells’ strong brand recall, premium product launches (like IoT-enabled smart fans and ACs), and government infrastructure spending on housing and smart cities.

- Recent Trends (2023-2024): Despite inflationary pressures and rising raw material costs (copper, steel), Havells maintained resilience due to pricing power and cost optimization. However, competition from Bajaj Electricals, Crompton, and new entrants led to margin pressures in some segments.

Key Factors Influencing Past Price Movements:

- Demand-Supply Dynamics:

- Rising urbanization and real estate growth boosted wiring cables and switchgear demand.

- Seasonal demand for fans and cooling products impacted quarterly performance.

- Competitive Landscape:

- Increased competition from organized players (like Polycab, Bajaj) and unorganized local brands in the fan & lighting segment.

- Havells’ focus on premiumization (smart home appliances, energy-efficient products) helped maintain market share.

- Macroeconomic Conditions:

- Commodity price fluctuations (copper, aluminum, steel) directly impacted production costs and margins.

- Government schemes (Housing for All, PLI for ACs) provided tailwinds for growth.

- Financial Health & Investor Sentiment:

- Consistent revenue growth (~10-12% CAGR) and strong cash flows kept investor confidence high.

- Dividend payouts (~1-1.5% yield) attracted long-term investors.

Key Factors Influencing Havells Share Price Target 2025-2030

The future trajectory of Havells share price will be shaped by a combination of industry trends, company-specific strategies, financial health, and external challenges. Here’s a detailed breakdown of the critical factors that could impact Havells Share Price Target 2025-2030:

Read More:- Motherson Sumi Share

A. Industry & Market Growth

1. Electrical & Consumer Durables Sector Outlook in India

- The Indian electrical equipment and consumer durables market is projected to grow at ~10-12% CAGR (2025-2030), driven by:

- Rapid urbanization and rising disposable incomes.

- Increased electrification in rural and semi-urban areas.

- Demand for energy-efficient appliances (BEE 5-star rated fans, ACs, LED lighting).

- Havells, as a market leader, is well-positioned to capitalize on this growth, especially in premium and smart home appliances.

2. Government Policies Boosting Demand

- PLI Scheme (Production-Linked Incentive) for ACs & LEDs – Benefits Havells’ manufacturing expansion.

- Smart Cities Mission & Housing for All – Increased demand for wiring, switches, and lighting solutions.

- Energy efficiency initiatives (UJALA scheme, inverter AC push) – Favors Havells’ R&D in sustainable products.

B. Company-Specific Growth Drivers

1. Expansion in Product Portfolio

- Havells is aggressively diversifying into high-margin segments:

- Smart & IoT-enabled devices (Wi-Fi fans, AI-powered ACs).

- Premium kitchen appliances (water purifiers, mixer grinders).

- EV charging infrastructure (emerging opportunity).

2. Strong Distribution Network & Brand Strength

- 5,000+ distributors and 1.5 lakh+ retail outlets across India.

- Brand recall as a trusted, premium electrical brand (less price-sensitive than competitors).

3. Export Potential & Global Partnerships

- Increasing focus on Middle East, Africa, and Southeast Asia.

- Strategic OEM partnerships to expand global footprint.

C. Financial Health & Fundamentals

1. Revenue & Profit Trends

- Revenue CAGR of ~10-12% (last 5 years).

- Margins under pressure (due to rising input costs) but expected to stabilize with premiumization.

2. Debt Levels & Cash Flow Analysis

- Low debt-to-equity ratio (<0.3) – Strong balance sheet.

- Healthy free cash flow – Supports R&D and dividends.

D. Risks & Challenges

1. Intense Competition

- Crompton, Bajaj, Polycab in fans & cables.

- New entrants (like Atomberg, Orpat) in energy-efficient appliances.

2. Raw Material Price Volatility

- Copper, steel, aluminum prices impact production costs.

- Hedging strategies & price hikes may offset some risks.

3. Economic Slowdown Impact

- Reduced consumer spending during recessions could hit demand.

- However, Havells’ essential product portfolio (fans, wires) provides resilience.

Havells Share Price Target: 2025, 2026-2028 & 2030 Forecast

Havells Share Price Target 2025 (Short-Term Outlook)

Read More:- TTML Share Price Target

The near-term outlook for Havells stock depends on current market trends and business performance:

| Factor | Impact on 2025 Price Target |

|---|---|

| Demand Trends | Expected 8-10% growth in consumer electricals |

| Margin Pressure | Raw material costs may limit upside |

| New Launches | IoT products could boost premium sales |

| Analyst Consensus | ₹1,600-₹1,800 (15-20% upside from current) |

Technical Analysis Insight:

- Key support at ₹1,350

- Resistance at ₹1,650

- RSI showing neutral momentum (45-55 range)

Havells Share Price Target 2026-2028 (Mid-Term Forecast)

The 3-year outlook appears promising with multiple growth drivers:

Growth Catalysts:

- Product Expansion:

- Smart home devices portfolio expected to double

- EV charging solutions rollout

- Market Expansion:

- 15% increase in retail touchpoints

- Export growth to Middle East/Africa

Economic Factors:

- 6-7% GDP growth to boost consumer spending

- Government housing schemes supporting demand

Projected Price Range:

- Base Case: ₹2,000-₹2,400 (2026-2028)

- Bull Case: ₹2,600+ (if export growth exceeds expectations)

Havells Share Price Target 2030 (Long-Term Projection)

Read More:-Waaree Energies Share Price

The 7-year outlook presents both opportunities and risks:

Bullish Scenario (₹3,000-₹3,500):

- Successful premiumization strategy

- Market share gains in IoT appliances

- Strong export performance

Bearish Scenario (₹1,800-₹2,200):

- Intense competition eroding margins

- Slow adoption of smart products

- Economic slowdown impacts demand

Key Value Drivers:

- Brand premiumization (15-20% revenue from smart devices)

- Cost optimization through automation

- EV infrastructure opportunities

Comparison Table: Havells 2030 Projections

| Scenario | Price Target | Probability | Key Drivers |

|---|---|---|---|

| Optimistic | ₹3,500 | 30% | Market dominance, export boom |

| Base Case | ₹2,750 | 50% | Steady 12% CAGR |

| Conservative | ₹2,000 | 20% | Margin pressures, slow growth |

Investment Recommendation

- Short-Term (2025): Hold with ₹1,800 target

- Mid-Term (2026-28): Accumulate on dips below ₹1,500

- Long-Term (2030): Core portfolio stock for growth investors

Expert Opinions & Brokerage Reports on Havells Stock

Leading brokerages have mixed but generally positive views on Havells’ future prospects:

Top Brokerage Recommendations (2024-2025)

| Brokerage Firm | Rating | Target Price | Key Remarks |

|---|---|---|---|

| Motilal Oswal | Buy | ₹1,850 | “Strong brand + distribution to drive 15% EPS growth” |

| ICICI Securities | Hold | ₹1,650 | “Margin pressures offset by premium product mix” |

| JP Morgan | Overweight | ₹1,900 | “Market leader well-positioned for housing boom” |

| Kotak Institutional | Reduce | ₹1,450 | “Valuations rich vs. near-term growth challenges” |

Consensus View:

- 65% analysts recommend BUY (12 out of 18 major brokerages)

- Average target price: ₹1,750 (18-20% upside potential)

- Key strengths cited: Brand equity, working capital efficiency

- Primary concerns: Input cost volatility, competition in fans segment

Should You Invest in Havells for Long-Term?

Pros vs. Cons Analysis

✅ Advantages of Investing:

- Market Leadership:

- No. 1 in fans (30% market share) & switches (25% share)

- Trusted brand with 65+ years legacy

- Growth Opportunities:

- Smart appliances segment growing at 25% CAGR

- Govt’s focus on infrastructure boosts wiring demand

- Financial Stability:

- Debt-free balance sheet since 2020

- Consistent 8-10% revenue growth

❌ Risks to Consider:

- Margin Pressures:

- 60% of costs tied to copper/aluminum (volatile prices)

- Competition:

- Crompton gaining in premium fans

- Chinese brands in AC segment

- Valuation Concerns:

- Currently trades at 45x P/E (higher than sector average)

Who Should Invest?

| Investor Profile | Suitability | Time Horizon |

|---|---|---|

| Conservative | Moderate | 5+ years (for dividend + steady growth) |

| Growth-Seeking | High | 3-5 years (betting on premiumization) |

| Short-Term Trader | Low | Volatility may limit quick gains |

Conclusion:

Havells India remains a strong long-term investment in India’s growing electrical and consumer durables sector, supported by its trusted brand, expanding product portfolio, and healthy financials. While near-term margin pressures and competition pose challenges, the company’s focus on premium appliances, smart home solutions, and government-driven infrastructure growth positions it well for Havells Share Price Target 2025-2030. Analysts project a 15-20% annual upside, with long-term targets reaching ₹2,500-₹3,500 by 2030 in bullish scenarios.

FAQs:

1. What will be Havells share price in 2025?

Analysts project ₹1,600–₹1,850 for 2025, assuming stable demand and margin recovery. Bullish scenarios could push it to ₹2,000+ if smart appliance sales accelerate.

2. Is Havells a good long-term investment?

Yes, for investors with a 3-5+ year horizon. Its strong brand, debt-free balance sheet, and growth in premium appliances support steady returns, though raw material risks persist.

3. What are the risks of investing in Havells?

- Commodity price swings (copper, aluminum)

- Competition from Crompton, Bajaj, and new entrants

- Slow adoption of premium IoT products

4. How does Havells compare to competitors like Crompton?

| Factor | Havells | Crompton |

|---|---|---|

| Market Share (Fans) | ~30% | ~25% |

| Premium Segment | Strong (IoT, ACs) | Growing |

| Valuation (P/E) | Higher (~45x) | Lower (~35x) |

| Dividend Yield | ~1.2% | ~1.5% |

Disclaimer:

The advice or opinions given on Taplumarket are the personal views of the expert, the brokerage firm, the website or management is not responsible for it. Before investing, please consult your financial advisor or certified expert.