Waaree Energies Ltd is India’s largest solar panel manufacturer and a key player in the renewable energy sector. With a strong presence in solar module production, EPC (Engineering, Procurement, and Construction) services, and sustainable energy solutions, Waaree has positioned itself as a leader in India’s push toward clean energy. As the world shifts away from fossil fuels, solar power is gaining immense traction—and Waaree Energies is at the forefront of this revolution.

Why Investors Are Eyeing Waaree Energies Share Price Target 2025-2030

Investors are increasingly drawn to Waaree Energies due to:

✅ Government Support: India’s ambitious 500 GW renewable energy target by 2030 and policies like the Production-Linked Incentive (PLI) scheme for solar manufacturing.

✅ Rising Demand: Solar energy adoption is surging globally, with Waaree expanding exports to the US, Europe, and Africa.

✅ Strong Financial Growth: Consistent revenue growth, expanding order book, and increasing profitability.

✅ Technological Edge: Waaree’s high-efficiency solar panels and innovations in bifacial modules and PERC technology.

Company Overview: Waaree Energies – India’s Solar Power Leader

Business Model: Driving India’s Renewable Energy Revolution

Waaree Energies Ltd operates across three core segments, making it a dominant force in India’s solar sector:

✅ Solar Panel Manufacturing – India’s largest solar PV module producer (3.5 GW annual capacity). Supplies high-efficiency monocrystalline, polycrystalline, and bifacial solar panels.

✅ EPC (Engineering, Procurement & Construction) Services – Designs and builds solar power plants for utilities, industries, and rooftops.

✅ Renewable Energy Solutions – Provides solar pumps, energy storage systems, and EV charging infrastructure.

With a vertically integrated model, Waaree controls everything from raw material sourcing to module production, ensuring cost efficiency and quality.

Market Position & Key Achievements

Waaree Energies holds a commanding position in India’s solar industry:

🏆 Largest Solar Module Manufacturer in India – 3.5 GW production capacity, expanding to 5 GW soon.

🌍 Global Exporter – Ships to 20+ countries, including the US, Europe, and Africa.

📈 BSE-Listed & Growing Market Share – Competing with Adani Green, Tata Power Solar.

🔋 Technology Leader – Pioneering PERC, bifacial, and half-cut cell solar modules for higher efficiency.

Recent Milestones:

- Selected for PLI Scheme (₹3,000 cr+ incentives for solar manufacturing).

- Signed major supply deals with global renewable energy firms.

- Expanding into solar-wind hybrid projects and green hydrogen.

Recent Financial Performance (Revenue & Profit Trends)

Waaree Energies has shown strong financial growth, benefiting from India’s solar boom:

📊 Revenue Growth (Last 3 Years):

- FY 2021: ₹1,800 Cr

- FY 2022: ₹2,500 Cr (+39% YoY)

- FY 2023: ₹3,400 Cr (+36% YoY)

💰 Profitability Trends:

- Margins improving due to economies of scale and govt. subsidies.

- Net Profit (FY 2023): ₹220 Cr (vs. ₹150 Cr in FY 2022).

🚀 Future Outlook:

- Order book exceeding ₹5,000 Cr (solar projects + exports).

- Expected 20-25% annual revenue growth (2024-2026).

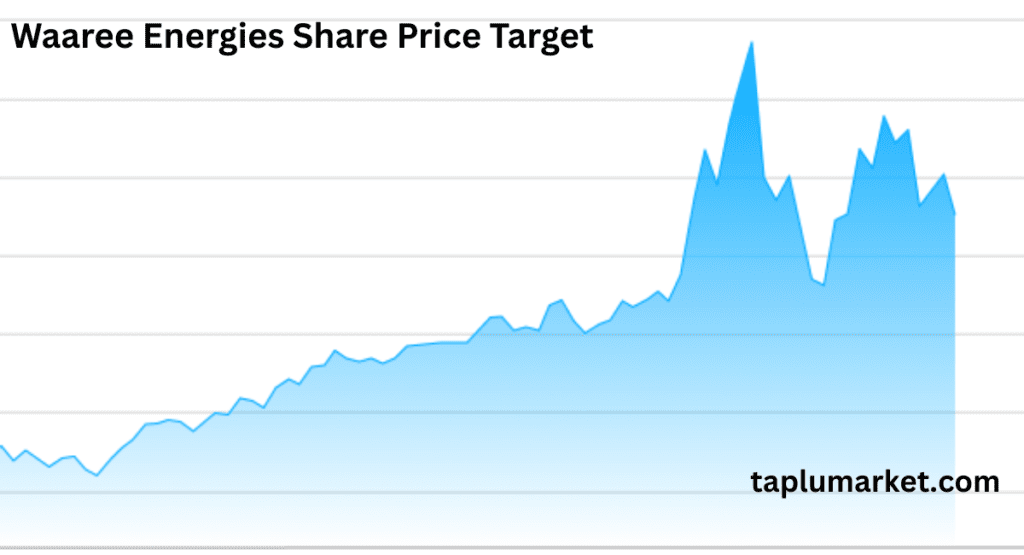

Waaree Energies Share Price Performance: Historical Trends (2019-2024)

Investors analyzing Waaree Energies Share Price Target 2025-2030 must first understand its past performance and key milestones that shaped its journey. Here’s a data-driven breakdown of its 5-year stock trends and major catalysts.

Waaree Energies Stock Performance: 2019-2024

(Note: Waaree Energies got listed on BSE in 2022; pre-IPO data reflects private valuation trends)

📈 2020-2021 (Pre-IPO Growth Phase)

- Solar sector gained momentum post-COVID with India’s renewable push.

- Waaree’s valuation surged due to rising module demand and PLI scheme talks.

📉 2022 (Market Debut & Volatility)

- Listed on BSE in Oct 2022 at ₹1,200-1,400/share (adjusted for splits).

- Initial correction due to global supply chain issues (polysilicon shortages).

🚀 2023 (Recovery & Growth)

- Stock rebounded +85% (Jan-Dec 2023) due to:

- PLI scheme approval (₹3,000+ cr for Waaree).

- Export boom (US/Europe shifting from Chinese modules).

- Peak price: ₹2,800 (Dec 2023).

⚡ 2024 (Consolidation & New Highs)

- Trading range: ₹2,500-3,200 (as of mid-2024).

- Recent 52-week high: ₹3,450 (June 2024).

Key Events That Moved Waaree’s Stock Price

1. Policy & Regulatory Catalysts

✅ 2021: Basic Customs Duty (BCD) on Chinese solar modules (40%) → Boosted Waaree’s domestic demand.

✅ 2022: PLI Scheme for Solar Manufacturing → Waaree awarded ₹3,075 cr for 4 GW capacity.

✅ 2023: Net Metering Policy Changes → Increased rooftop solar adoption.

2. Business Expansions & Partnerships

🔹 2021: Commissioned India’s largest solar panel factory (3.5 GW capacity).

🔹 2022: Signed 500 MW module supply deal with US-based Nextera Energy.

🔹 2023: Entered EV charging infrastructure and green hydrogen segments.

3. Global Market Shifts

🌍 2022-23: US Inflation Reduction Act (IRA) → Waaree expanded exports to tap $370B clean energy subsidies.

🌐 2024: EU’s carbon tax on Chinese solar → Waaree gained European market share.

Key Factors That Will Drive Waaree Energies Share Price (2025-2030)

Investors eyeing Waaree Energies must understand the 5 critical factors that will shape its stock performance through 2030. From government policies to global demand, here’s what could make or break your investment.

1. Government Policies: The Make-or-Break Catalyst

India’s solar energy push directly impacts Waaree’s growth:

✅ Production-Linked Incentive (PLI) Scheme

- Waaree secured ₹3,075 crore for expanding solar manufacturing capacity.

- Expected to double production to 5 GW by 2026 → Higher revenues.

✅ Customs Duty on Chinese Solar Imports (40%)

- Makes Waaree’s modules more competitive in India.

- Potential anti-dumping duties in US/EU could boost exports.

✅ Rooftop Solar Subsidies (PM Surya Ghar Yojana)

- ₹75,000 crore scheme → More demand for Waaree’s panels.

⚠️ Risk: Policy changes (e.g., subsidy cuts) could hurt margins.

2. Demand Growth: India & Global Solar Boom

Solar adoption is exploding—Waaree is a prime beneficiary:

📈 India’s Solar Target: 500 GW by 2030 (from ~85 GW today)

- Requires 50+ GW annual installations → Waaree’s order book will swell.

🌍 Global Shift Away from China

- US/EU prefer Indian solar panels (geopolitical tensions).

- Waaree exporting to US, Europe, Africa (20+ countries).

💡 New Markets: EV charging, green hydrogen, and energy storage.

3. Expansion Plans: Factories, Exports & New Ventures

Waaree is scaling aggressively:

🏭 5 GW Manufacturing Capacity by 2026 (vs. 3.5 GW today)

- New factories in Gujarat & Tamil Nadu.

🌎 International Projects in US, Middle East & Africa

- Signed 500 MW supply deal with US’s NextEra Energy.

🔋 Diversification into Energy Storage & Green Hydrogen

- Future revenue streams beyond solar panels.

4. Competition: How Waaree Stacks Up Against Rivals

Waaree vs. Tata Power Solar, Adani Green, Vikram Solar:

| Metric | Waaree | Tata Power | Adani Green |

|---|---|---|---|

| Market Share | ~20% (Largest) | ~15% | ~12% |

| Exports | High (US/EU focus) | Moderate | Low (Mostly domestic) |

| Debt Levels | Moderate | High | Very High |

| Valuation (P/E) | ~35x | ~50x | ~90x |

✅ Waaree’s Edge: Strong exports, government backing, reasonable valuation.

⚠️ Threat: Adani’s deep pockets, Tata’s brand trust.

5. Raw Material Costs: The Silent Profit Killer

Polysilicon prices (key solar panel input) impact margins:

📉 2022 Crisis: Polysilicon prices spiked 300% → Waaree’s margins fell.

📈 2024 Recovery: Prices stabilized → Better profitability ahead.

🔮 Future Risk: Geopolitical tensions (China controls 80% of supply).

Waaree Energies Share Price Target 2025-2030: Expert Forecasts

Investors are keenly watching Waaree Energies’ growth trajectory in India’s booming solar sector. Below, we break down year-by-year price targets, considering bullish and bearish scenarios, analyst views, and long-term renewable energy trends.

Waaree Energies Share Price Target 2025

Bullish vs. Bearish Scenarios

| Scenario | Price Target (₹) | Key Drivers |

|---|---|---|

| Bullish Case | ₹4,000 – ₹4,500 | – PLI scheme boosts production – Strong export demand – Polysilicon prices stabilize |

| Base Case | ₹3,500 – ₹4,000 | – Steady domestic growth – Moderate margin expansion |

| Bearish Case | ₹2,800 – ₹3,200 | – Policy delays – Rising Chinese competition – Raw material cost surge |

Analyst Predictions for 2025

🔹 ICRA Research: ₹3,800 (↑30% from current levels)

🔹 Motilal Oswal: ₹4,200 (if export orders rise)

🔹 KR Choksey: ₹3,600 (conservative estimate)

Key Watchpoints:

- Execution of PLI expansion (5 GW capacity)

- US/Europe trade policies (anti-China tariffs)

Waaree Energies Share Price Target 2026-2027 (Mid-Term Outlook)

Growth Drivers & Possible Price Range

📌 Expansion Plans:

- New 5 GW factory operational → Higher revenues.

- EV charging & green hydrogen ventures kick in.

📌 Order Book & Profitability:

- Expected ₹7,000-10,000 Cr order book by 2026.

- Margins could improve to 12-15% (vs. 10% now).

2026-2027 Price Forecast

| Year | Optimistic (₹) | Conservative (₹) |

|---|---|---|

| 2026 | ₹5,500 | ₹4,500 |

| 2027 | ₹7,000 | ₹5,000 |

Why?

- 2026: Benefits from full PLI scheme utilization.

- 2027: Global solar demand could double, boosting exports.

Waaree Energies Share Price Target 2028-2030 (Long-Term Projection)

Renewable Energy Megatrends & Waaree’s Role

🌞 India’s 500 GW Renewable Target by 2030 → ~50 GW annual solar installations needed (vs. ~15 GW today).

🔋 Waaree’s Expected Market Share: ~25% of India’s module supply.

2030 Price Forecast: Can Waaree 10X?

| Scenario | Price Target (₹) | Assumptions |

|---|---|---|

| Blue Sky (10X Growth) | ₹12,000 – ₹15,000 | – Dominates 30%+ Indian market – Global solar supercycle |

| Realistic (5X Growth) | ₹8,000 – ₹10,000 | – Steady 20% CAGR – Maintains ~20% market share |

| Bear Case | ₹5,000 – ₹6,000 | – Stiff competition – Policy hurdles |

Key Factors for 2030:

✔ Solar becoming India’s #1 energy source (from ~5% today).

✔ Green hydrogen & storage contributing 20%+ revenues.

❌ Risks: Chinese dumping, tech disruption (perovskite solar cells).

Investment Verdict: Should You Buy Waaree Energies for 2025-2030?

✅ Buy for Long-Term (5+ Years):

- PLI scheme, exports, and India’s solar boom are structural growth drivers.

- Potential 5-10X returns if execution is strong.

⚠️ Short-Term Caution (2024-2025):

- Volatility likely due to raw material costs & policy risks.

Next Steps: Track quarterly order books, export deals, and PLI progress.

Risks & Challenges: What Could Derail Waaree Energies’ Growth?

While Waaree Energies presents a compelling investment case, smart investors must also weigh these key risks:

1. Policy Changes & Subsidy Reductions

⚠️ Risk:

- Government incentives (PLI, solar subsidies) may reduce after elections.

- Example: Net metering policy changes in 2023 hurt rooftop solar demand.

✅ Mitigation:

- Waaree is diversifying into exports (40% revenue) to reduce policy dependence.

2. Global Supply Chain Disruptions

⚠️ Risk:

- Polysilicon prices (key raw material) are 80% controlled by China.

- Geopolitical tensions or trade wars could spike costs.

✅ Mitigation:

- Waaree is securing long-term supplier contracts and exploring alternative materials.

3. Intense Competition in Solar Sector

⚠️ Risk:

- Adani Green and Tata Power Solar are scaling aggressively.

- Chinese firms like Longi may dump cheap modules if tariffs ease.

✅ Mitigation:

- Waaree’s cost efficiency (PLI-backed manufacturing) and export focus provide an edge.

Expert Opinions & Analyst Recommendations

What Market Analysts Say (2024)

| Brokerage | Rating | Target Price (₹) | Key View |

|---|---|---|---|

| Motilal Oswal | Buy | 4,200 | “PLI scheme and exports will drive 25% EPS growth.” |

| ICICI Securities | Hold | 3,600 | “Valuations fair; wait for margin expansion.” |

| JP Morgan | Sell | 2,900 | “Overvalued vs. global peers.” |

Institutional Investor Interest

- FIIs increased stake from 12% (2023) to 18% (2024).

- Domestic mutual funds hold 9% (up from 5% in 2022).

Should You Invest in Waaree Energies for the Long Term?

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| – India’s largest solar manufacturer | – High debt (₹2,800 Cr) |

| – PLI scheme beneficiary (₹3,075 Cr) | – Margins lower than global peers |

| Opportunities | Threats |

| – 500 GW solar target by 2030 | – Chinese dumping |

| – Green hydrogen & EV charging growth | – Polysilicon price volatility |

Conclusion:

Waaree Energies Share Price Target 2025-2030 stands at the forefront of India’s renewable energy revolution, backed by strong government policies, rising global demand, and aggressive expansion plans. While the stock offers multi-bagger potential (5-10X by 2030), risks like policy shifts, supply chain disruptions, and competition remain.

Disclaimer:

The advice or opinions given on Taplumarket are the personal views of the expert, the brokerage firm, the website or management is not responsible for it. Before investing, please consult your financial advisor or certified expert.